DIBS – Banking application and service environment

A study conducted by PricewaterhouseCoopers and George Washington University found that Millennials are educated, but not about finance. 24% demonstrated basic financial knowledge and 54% expressed concern over repaying their student loans. These numbers are staggering. Financial education is not integrated into our school systems, and even within families not talked about enough.

According to an ING International survey, kids who receive pocket money are more likely to save money. As kids we are constantly told to save money, but not fully explained how to go about it.

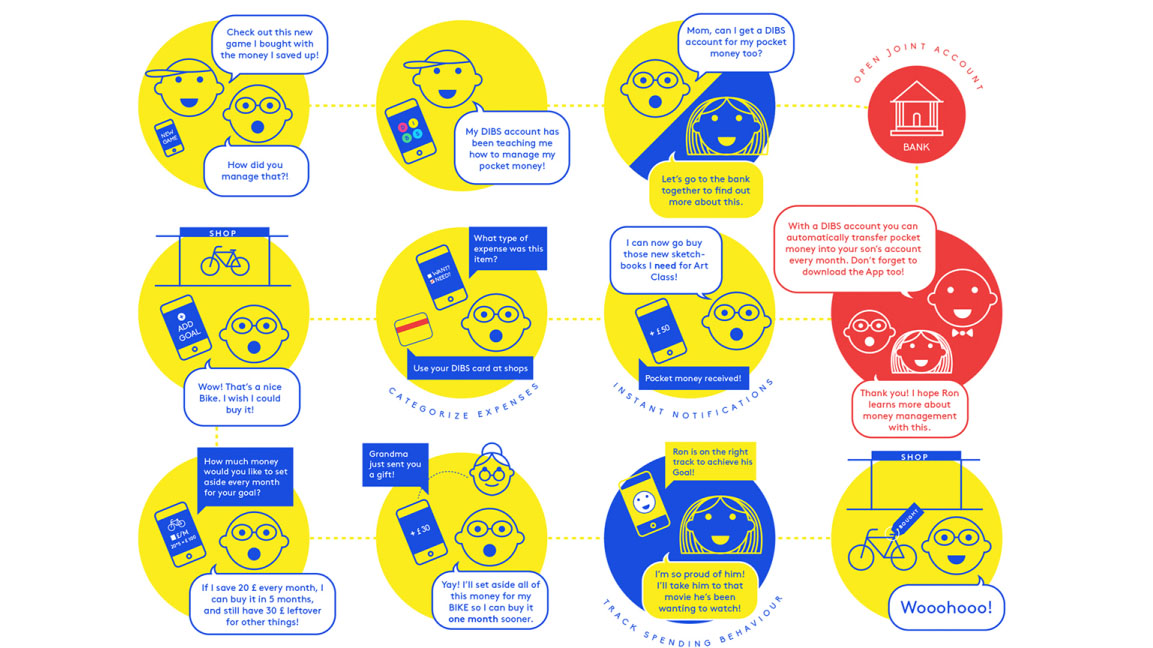

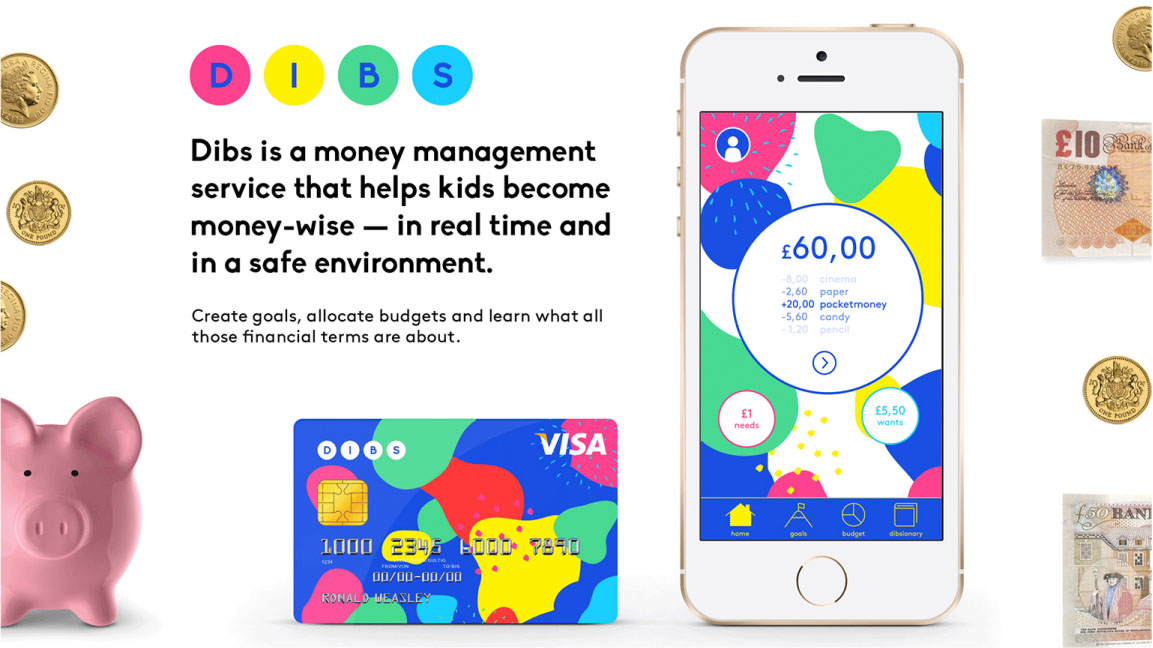

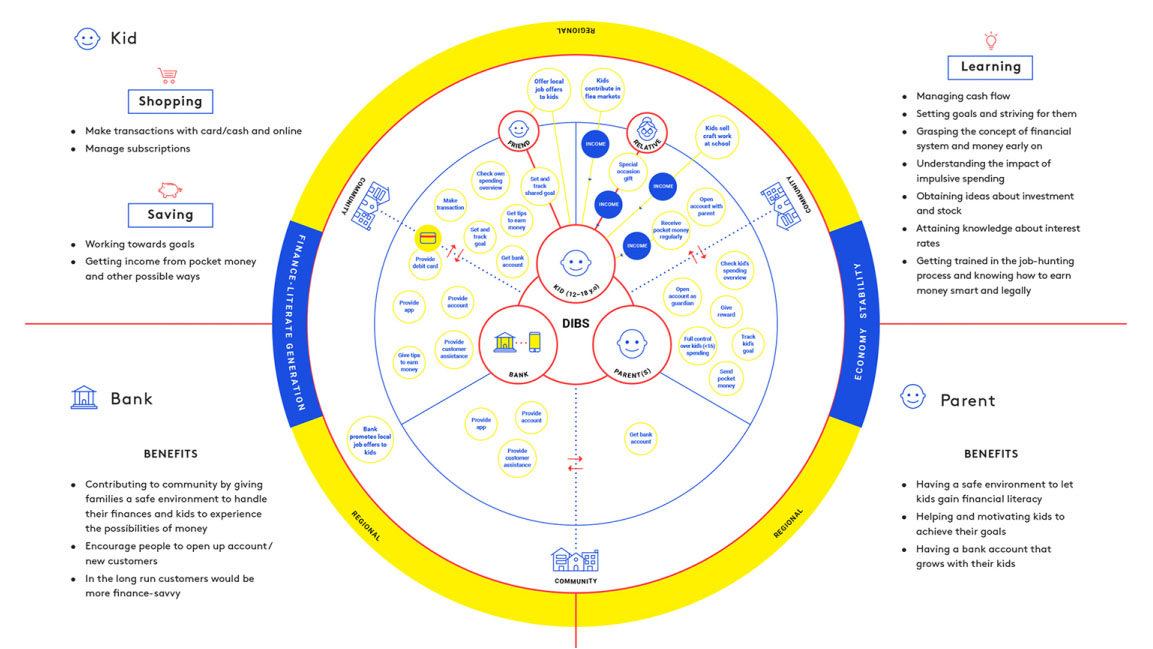

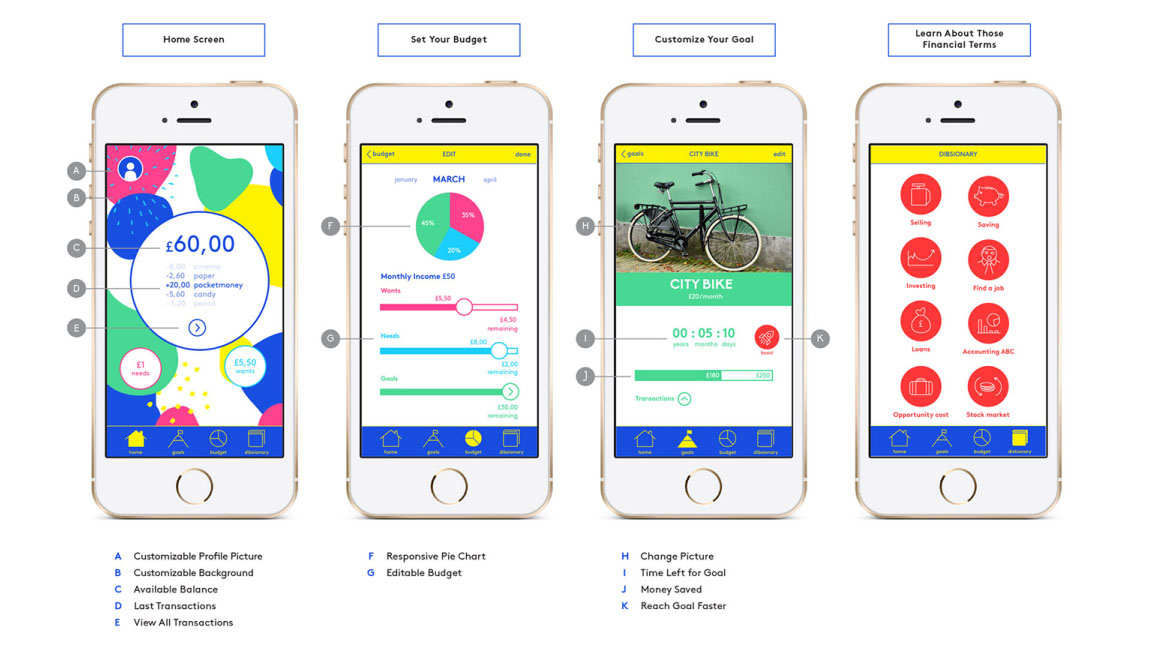

And suddenly when adulthood hits we must learn to make important decisions regarding our money with very little or sometimes no experience. Dibs is a money management service for kids. Parents and children can open joint bank accounts and use Dibs to manage monthly allowances. Dibs has two versions, one for the child and one for the parent. Kids can use it to manage their money by creating budgets and tracking their expenses. The app helps them save by letting them choose their own goals and provide them with a savings plan. A section of the app is dedicated to help kids learn more about investing, stocks, interest rates, mutual funds etc. Parents can easily track their child’s expenses using the app plus have full control of them. Dibs is a safe environment and helps kids with their first steps into the financial system, with a bank account that grows and adapts with them — from childhood to adulthood.

Context

The project was initiated during the course “Design Challenges” at the department of Media at the Aalto University in 2017. The incentive of the course was to develop a concept meeting one of the RSA student design award's briefs.

The concept was shortlisted for the student design award of the RSA 2017 and “commended” by the judging panel for the brief "mind your money".

Team members

Maya Pillai

Retno Hadiningdiah

Kilian Kottmeier